Running an online business is not easy, especially when it comes to managing stripe taxes. If you use WordPress and sell products, digital goods, or subscription services through the Stripe payment gateway, collecting correct taxes is very important.

Collecting correct taxes saves you from legal hassles and also maintains customer trust.

In this blog, we will tell you 3 easy ways by which you can easily collect Stripe taxes payments on your WordPress site. Whether you’re using WP Simple Pay, Woo Commerce, or Easy Digital Downloads, we’ll cover tools tailored to your needs. Plus, there’s a bonus section on creating professional invoices to keep your customers happy and informed.

By the end of this post, you’ll have a clear, actionable strategy to streamline your tax management process.

Want to stay ahead with AI-driven change footer in WordPress insights and stay updated with the latest trends? Subscribe for daily search insights at wpguidepro.com to improve your WordPress strategy.

Table of Contents

Why Collect Stripe Taxes Payments in WordPress?

If you are using Stripe taxes on your WordPress site to collect payments, you are already using a powerful system. But if you don’t collect taxes, you could face problems such as legal issues, having to pay too much money, and angry customers.

Collecting taxes on Stripe payments is very important. Here are some reasons:

• Following the law (Tax Compliance): Many countries and states have rules that it is necessary to collect sales tax or VAT on online products. If you don’t do this, you could face a penalty or fine.

• Making the customer feel good: When you display the correct tax amount at the checkout, the customer trusts you and is not confused.

• Creating reports easily: Tax tools can help you or your accountant create tax reports quickly and easily.

There are tools available for WordPress users that make tax collection easy. Below we will tell you the best solutions for every type of business.

Collect Taxes for Subscriptions, Services, and Single Products

If your business mainly sells subscription plans, services, or other products, then WP Simple Pay is the best option for handling Stripe taxes and payment.

WP Simple Pay is a light and simple plugin that helps you set up one-time and recurring payments — and it also calculates tax automatically.

How to Setup Tax in WP Simple Pay:

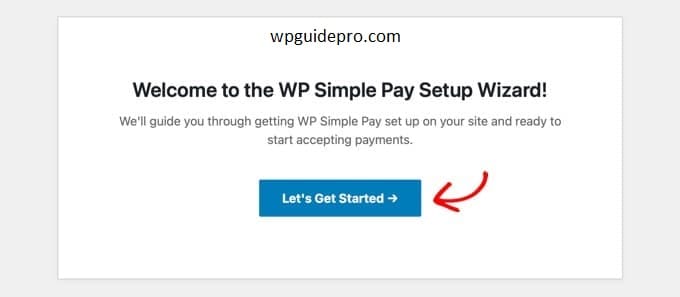

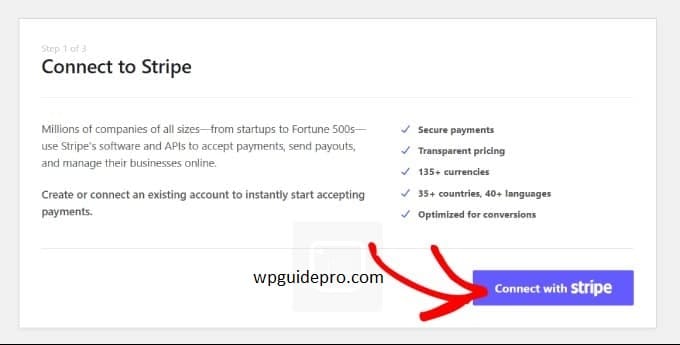

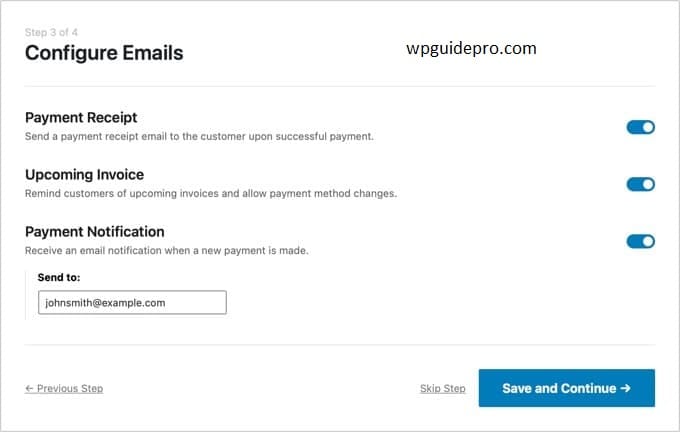

Install and Activate Plugin

Download WP Simple Pay plugin through WordPress and connect your Stripe account.

Enable Tax Option

Go to Settings. Here you can turn on the tax collection option. WP Simple Pay will calculate tax based on your customer’s address.

Create Pricing Plans or Payment Forms When you’re setting the price of your product or service, add a tax rate option so that each item or subscription is taxed correctly.

Show Tax at Checkout WP Simple Pay works well with Stripe taxes Checkout, and shows customers their local tax rate at checkout, before purchasing.

Why use WP Simple Pay?

• It’s very easy to use

• Best for people who offer services, memberships, or consulting

• You don’t need to build a full eCommerce store

Collect Taxes for Physical Products (WooCommerce)

If you sell physical products, Woo Commerce is the best plugin. In this, you can easily set tax rates for different areas, and Stripe taxes payments are also managed smoothly.

How to Set Tax in WooCommerce

- Install WooCommerce First of all, install the WooCommerce plugin on your WordPress website.

- Turn on Tax Option Go to WooCommerce settings and turn on the “Enable Taxes” option so that you can set tax.

- Set Tax Rates Using the built-in tax classes, you can set tax rates according to country, state, or ZIP code. WooCommerce also supports reduced or zero tax rate, in some special cases.

- Add Stripe Payment Gateway Install the “WooCommerce Stripe Payment Gateway” plugin to handle Stripe payments.

Show the correct tax at checkout When you have set area-specific tax rates, WooCommerce shows the correct tax to the customer in the checkout and cart.

Why use WooCommerce?

• Full options are available for those selling physical products

• You can set location-based or multiple levels of tax

• Easily integrates with Stripe taxes

WooCommerce is a flexible and powerful tool, perfect for any e-commerce website, big or small.

Collect Taxes for Digital Products (Easy Digital Downloads)

How to Set Tax through Easy Digital Downloads (EDD)

Install EDD Download and activate Easy Digital Downloads plugin on WordPress site.

Turn on Tax Option Go to EDD Tax Settings and enable taxes for your digital products. You can choose whether to apply tax based on customer location, VAT or any other basis.

Set Product Pricing EDD automatically calculates tax on digital products, and applies different taxes based on VAT rules in different regions (such as European Union).

Add Stripe Payments The EDD Stripe Gateway add-on makes it easy to receive payments through Stripe.

Show VAT Details EDD shows the proper VAT breakdown at checkout for customers who shop from international areas (where there are VAT laws).

Why use Easy Digital Downloads?

• This plugin is specifically designed for digital product stores

• Easily handles complex tax rules like EU VAT

• Special add-ons are available for Stripes and automation

EDD makes it easy for you to manage your taxes without any extra stress, and your digital business stays in accordance with the law.

Bonus: Create Visually-Appealing Invoices for Customers

Taxes aside, a polished invoice is one of the best ways to enhance the professionalism of your business. Regardless of whether your business falls under services, digital products, or physical goods, ensuring clear, attractive invoicing helps you maintain trust with customers.

Features to Look for in an Invoice Tool:

- Clear breakdown of subtotal, taxes, and total due.

- Branding options, such as adding your logo.

- Customizable fields for specific customer information or payment terms.

Tools for Creating Customizable Invoices:

- WP Simple Pay: Offers invoice capabilities directly integrated with Stripe.

- WooCommerce PDF Invoice Plugins: Automatically generates PDF invoices for every sale.

- Easy Digital Downloads Invoice Add-on: Provides custom invoices for digital products.

Invoices not only ensure compliance but also provide customers with a seamless post-purchase experience, increasing the likelihood of return business.

Conclusions

Managing taxes doesn’t have to be a difficult task. If you have the right tool like WP Simple Pay, Woo Commerce, and Easy Digital Downloads (EDD).

You can easily automate tax collection.

These Three plugins work great with Stripe, giving your customers a smooth and easy checkout experience

This way you can comply with tax rules and focus on growing your business.

Reduce your stress and improve your e-commerce process today.

Choose the plugin that’s best for your business and let your tax collection system run smoothly with Stripe

Recommended Guide:

Accept iDEAL payments https://wpguidepro.com/how-to-accept-ideal-payments-in-wordpress/

Product bundles in WooCommerce https://wpguidepro.com/sell-product-bundles-in-woo-commerce/

Cookies blocked issue https://wpguidepro.com/cookies-blocked-error-in-wordpress/

Login page redirect issue https://wpguidepro.com/fix-wordpress-login-page-redirecting-issues-quickly/

400 bad request AJAX error https://wpguidepro.com/wordpress-admin-ajax-400-bad-request-error/